As Productivity Slows: A Return to the DIY Economy

For much of the past several decades, our economy has been built on “productivity gains,” enabled by the significant growth in the service economy. Since 1980, the number of Americans performing service labor jobs has grown by 25% to represent nearly three quarters of all jobs in America. These service jobs are important because they enable other workers to outsource elements of their lives, which in turn provide more time for the pursuit of productivity and prosperity across all workers. But the fallout of COVID-19 may change this trend markedly.

Over the past two months, we hypothesized internally that COVID-19 might change American families’ reliance on the service economy as they became forced to adapt to the reality of fending for themselves while sheltering in place – no childcare, no house repairs, no baristas to prep your favorite drinks. And new data we collected appears to validate that thesis:

The consensus was stark: nearly three quarters of respondents expect a lasting, material impact on their daily purchasing habits. Over 40% of respondents affirmed growing conviction in their own abilities to accomplish DIY projects, learn new skills and more frequently fend for themselves. Nearly half of respondents expect to spend substantially more time cooking for themselves at home than they did prior to shelter in place orders. And over a third of respondents expect to purchase substantially fewer impulse drinks such as Starbucks lattes than they did prior to Covid-19.

Many investors believe that without a novel platform shift (i.e. world wide web, mobile computing) economic growth tailwinds will continue to slow and new economic value will be harder to unlock. But we respectfully disagree. We have always been of the belief that value is generated through mass behavioral change – which is often, though not always – catalyzed by innovations in technology. For example, the social changes catalyzed by World War II are still felt today – from major professional shifts such as 6.2M women entering the workforce for the first time – to indelible impacts on fashion and apparel caused by raw material shortages during the war.

Which and to what degree outcomes will be generated by COVID-19 behavior changes is still unknowable – but the scope of these forced shifts in behavior is nearly unprecedented, suggesting purchasing habits will changed markedly and innovation opportunities will abound.

The DIY Economy

The data we gathered suggests that Americans are fundamentally rethinking what they’re willing to pay for. For example, in the home maintenance and repair categories, our findings suggest that some real percentage of paid service requests may never come back – with roughly 40% of respondents reflecting an increased confidence in their own abilities to accomplish DIY tasks:

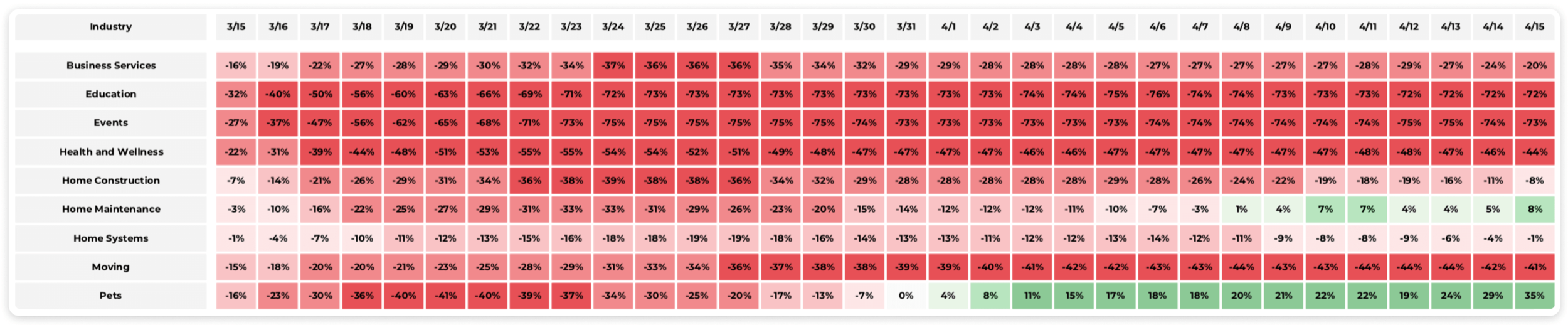

As households sheltered during March and early April, they were forced to solve their own problems; and now that they’ve figured it out, they appear to feel emboldened. A recent update on contractor trends published by Thumbtack appears to validate this changing behavior. Home maintenance requests plunged by 30-50% in the weeks following the pandemic response, and while they saw some normalization towards mid-April, it was nowhere near material enough to offset the sizeable losses during the March period. It’s possible those households have left the outsourced maintenance market for good.

And it’s not just home repair. Across the board, our findings reflected a growing confidence to take ownership of frequently outsourced tasks such as cooking food and brewing coffee, likely saving those spenders thousands and thousands of dollars annually that can either be allocated towards savings or re-allocated towards other consumption baskets*.

Each time a consumer elects to produce their own good with their own time rather than to outsource it, they are trading the incremental productivity and earnings of that time for the enjoyment of the good produced and the saved cost of not outsourcing. Typically, a worker is able to earn more money during that enabled time than it costs them to outsource, suggesting that a reversal of outsourcing is principally about the wellness and enjoyment derived from producing one’s own goods. (A recent Washington Post podcast with ancient bread maker Seamus Blackley supports this inference, suggesting that Americans are turning to breadmaking – microbes over which we have power – in contradistinction to Corona Virus which are microbes over which we do not yet have power.)

It is wholly uncertain how many of these behavioral changes will sustain if and when COVID-19 has run its course. But just as the past several decades have been defined by an accelerated pursuit of productivity, the next several may well see an acceleration in trends towards mental health and wellness – which are often at odds with the unyielding pressures of productivity. If that is the case, we would expect to see tectonic shifts in the types of jobs needed to support those changes and the types of behaviors consumers choose to embrace.

Our COVID-19 consumption survey was conducted with 755 respondents over three days in May. A full breakdown of the findings and demographics can be viewed here:

If you are building digital or physical products, services and/or experiences that you believe fit into the future DIY economy, we would love to hear from you at Starting Line.

This survey was a Starting Line team effort and my deepest thanks to Haley for her hard work in aggregating, crunching, and making sense of all the disparate data.

*Anecdotally, one of our portfolio companies interviewed nearly 300 consumers after receipt of their stimulus checks and the most common purchase across those interviews was shoes!